Pacific Sunwear executives have been informing shoe companies this week that the industry’s largest customer is dropping most shoes except sandals, according to brand executives.

As a result, some companies are trimming budgets and looking for new revenue streams.

A Pacific Sunwear spokesman could not be immediately reached for comment.

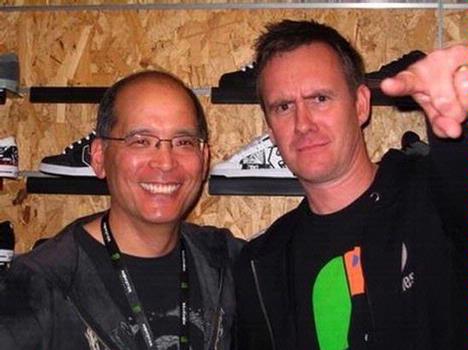

Paul Migaki, Sole Technology’s chief operating officer, told me this afternoon at ASR that Pacific Sunwear accounts for 5 percent of the company’s global business.

“It’s not small, but it’s not crippling,” he said. Sole Tech’s diversification over the past few years will help soften the blow. The company is both domestic and international and includes apparel and footwear, he said.

Paul had just come from a meeting with PacSun executives who told him the national retail chain was still interested in buying Sole Tech’s sandals. PacSun and Sole Tech also scheduled a meeting next week to talk about Sole Tech’s apparel lines.

Sal Barbier holds the updated Sal 23

Sal Barbier holds the updated Sal 23 shoe, a collaboration between Etnies,

Sal and the sneakerhead store

In4mation in Hawaii. It’s part of the

Etnies Recognition line, only available

in core stores.

“When one door closes, another one opens,” Paul said. “Our focus (with PacSun) will move to growing our apparel business with them. Of course that business is not the same as our footwear business with them.”

Sole Tech felt an economic slowdown coming so has been careful hiring new employees this year after several years of rapid growth. Company spokesman Brenda Springer said the company does not have a hiring freeze and is not planning layoffs, but is trimming expenses and programs.

Paul believes it will be easier to ride out the slowing economy as a private company.

“Unlike others, we don’t have a million public shareholders to answer to. We have one,” Paul said, referring to CEO and founder Pierre André Senizergues. “While it’s easier, that one is still interested in the company as well.”

Vice President of Marketing Don Brown and Paul believe the slowness in skate shoes is a result of too much product in the market, much of it that looks similar.

The Recognition line for fall also

The Recognition line for fall also includes a collaboration with

the New York skate brand Verte,

primarily an apparel line.

Verte and Etnies created two shoes

and a leather jacket with

a New York City vibe.

“Eventually, I think we’ll see consolidation in the footwear industry,” Paul said. “There’s so much sameness out there, only those that differentiate will survive.”

Sole Tech plans to do just that and support core retailers, Don said.

One question I’ve been wanting to ask the company: Is it harder to compete now that so many of Sole Tech’s competitors are owned by public companies or large private companies with deep pockets?

“It is more challenging,” Paul said. “I believe we are one of the largest, independently owned action sports brands. But if you play in your niche really well, you should be able to out maneuver them in the end. We have very good competitors but we are up to the task.”