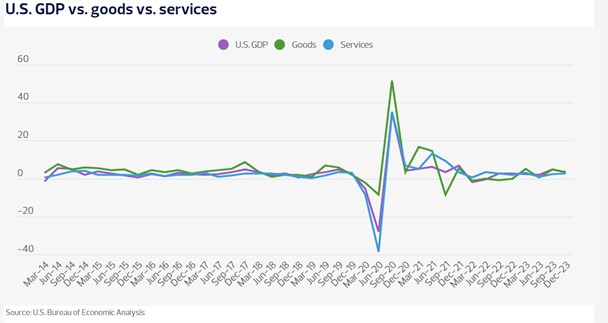

Retailers, including those in the outdoor sports retail sector, are approaching 2024 with cautious optimism. Signs of strength in the U.S. economy were highlighted in the December U.S. Department of Commerce report, which showed 3.3% expansion in U.S. gross domestic product.

Retail sales are holding strong, demonstrating growth despite expectations of soft demand. Disposable income experienced month-on-month growth of 0.1%; when adjusted for inflation, it surged by 4.2% for the year, according to the U.S. Bureau of Economic Analysis. This boost in real income signifies an increase in consumer purchasing power.

Source: Bureau of Economic Analysis

The University of Michigan’s bellwether consumer sentiment report in January 2024 showed that retail consumers’ optimism rose as the overall index surged to 78.8 from 69.7, surpassing the median consensus forecast of 70.1 by a significant margin.

To capitalize on heightened consumer optimism, executives are actively seeking strategies to expand their businesses. Many retailers prioritize new store growth as they aim to enter new markets. This expansion not only enhances in-store revenue but also boosts e-commerce and social channel sales due to increased brand consideration by consumers.

Additionally, customers seek convenience through options like “buy online, pick up instore” and “buy online, return in store.” This unified commerce approach to scaling will encourage executives to set ambitious targets for new stores. However, as executive teams focus on growth, they face two major challenges: the high cost of capital and the tight labor market.

Capital dynamics: Strategic adjustments for growth in a shifting economic landscape

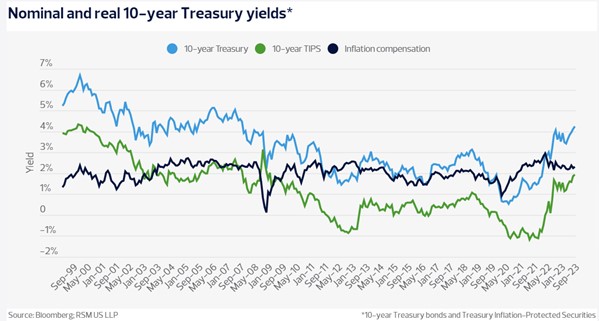

For the 15 years prior to 2023, chief financial officers have enjoyed the luxury of a low cost of capital, often at or below the inflation rate. Today, however, those rates have risen significantly above inflation. Executives should anticipate rates remaining positive for an extended period as the U.S. economy aims for a soft landing.

The Federal Reserve may cut rates this summer, but rates are still expected to remain higher than pre-hike levels. With the prospect of higher rates persisting, executive teams must adjust their operating strategies to exercise greater diligence regarding debt.

Source: Bloomberg; RSM US LLP

Considering these circumstances, executive teams need to adopt a conservative approach to their growth strategies, emphasizing a “measure twice, cut once” mentality instead of testing multiple strategies and choosing the winner. In the past, the lower cost of capital made less profitable growth strategies viable, but this has changed with higher real rates.

Companies must develop tools and processes to forecast their growth strategies accurately and make data-driven decisions to ensure positive-growth outcomes. These tools should consider macroeconomic trends and incorporate what-if analysis, as the tools will prove more reliable than relying solely on historic sales data. The upheaval in sales caused by the pandemic has accentuated the need for such accuracy and relying on sales data from 2020 to 2023 is challenging.

Navigating the tight labor market: Strategies for growth amid rising costs

As companies embark on expansion, particularly through new store openings, they must be acutely aware of the tight labor market. With the unemployment rate averaging 3.7% in 2023, according to the U.S. Bureau of Labor Statistics—the lowest since the 1950s—finding suitable labor is becoming increasingly challenging. Job seekers are often already employed and pursuing better opportunities, making it imperative for companies to prioritize both employee retention and workforce productivity.

Given the fierce competition for labor, many businesses will likely need to make adjustments to their labor costs to retain their workforce. As the true cost of labor continues to rise, automation and workforce optimization will become pivotal. Extracting greater productivity from each employee will enable businesses to sustain higher wages while remaining profitable. Companies will explore automated checkout systems, mobile ordering solutions, and more efficient processes. Many of these initiatives not only present opportunities for profitable growth but also can enhance the overall customer experience.

Unified commerce: Meeting customer expectations in a tight labor market

Unified commerce growth offers a dual solution to address the challenges posed by the tight labor market and the need to meet consumer expectations. Customers who now prioritize convenience, a seamless brand experience, and value, are increasingly attracted to brands that provide a unified digital platform. This enables companies to provide a consistent customer experience through all sales channels including instore, ecommerce, social media and marketplaces.

In the middle market, retailers are turning to technology partners to stay competitive with retail giants like Amazon, which have developed in-house custom solutions. Technology partners like Shopify, which helps merchants unify sales on one platform, are placing a strong emphasis on delivering affordable technologies that align with customer expectations in the middle market. Companies are actively seeking these partnerships to enhance their technology infrastructure and meet the growing demands of consumers.

As these platforms improve the customer experience, the significant inefficiencies in customer processes, such as merchandise returns, can substantially reduce labor demands. Labor forces operating on more efficient customer technology platforms can redirect their efforts toward generating customer demand. Enhanced efficiency also contributes to better customer retention. Balancing the fulfillment of customer expectations with labor challenges will be a top priority for retailers as they make strategic investments.

Portions of this article originally appeared in The Real Economy Industry Outlook: Retail and restaurant.